Who We Are

We at Mirae Asset Financial Services (India) aim to help with your financial requirements in the most convenient and simplified manner. In the contemporary landscape of finance, we set ourselves apart by delivering lending products in a simple, fast, transparent, and convenient manner, capitalizing on the latest technological advancements. From the initial customer onboarding process to subsequent post-onboarding activities and all service-related interactions, Mirae Asset Financial Services leverages modern technology to streamline and enhance efficiency at every step of the customer lifecycle.

Established in 2020, we operate as a licensed Non-Banking Financial Company with our headquarters situated in Mumbai. With a workforce spanning across various teams such as sales & marketing, credit risk & collections, customer support, finance, legal & compliance, human resources, operations, and information technology, we are dedicated to pushing the boundaries of traditional lending practices and charting the course toward a future defined by accessible and innovative financial solutions.

Our Products

Personal Loan

11.49% .p.a*

10 Mins**

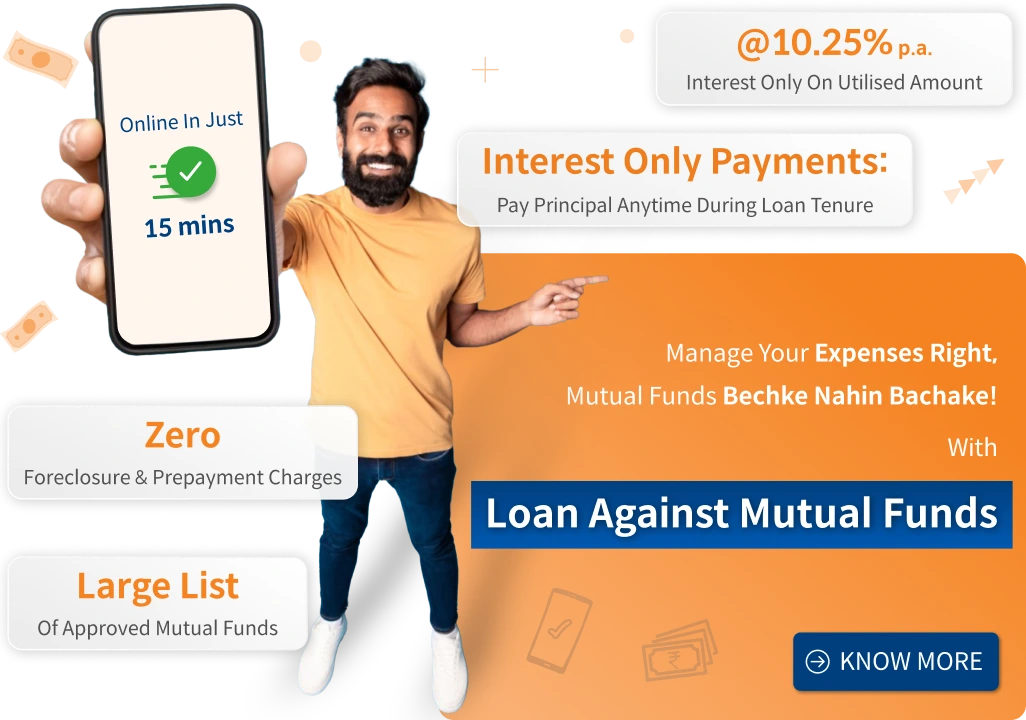

Loan Against Mutual Funds

10.25% .p.a

15 Mins

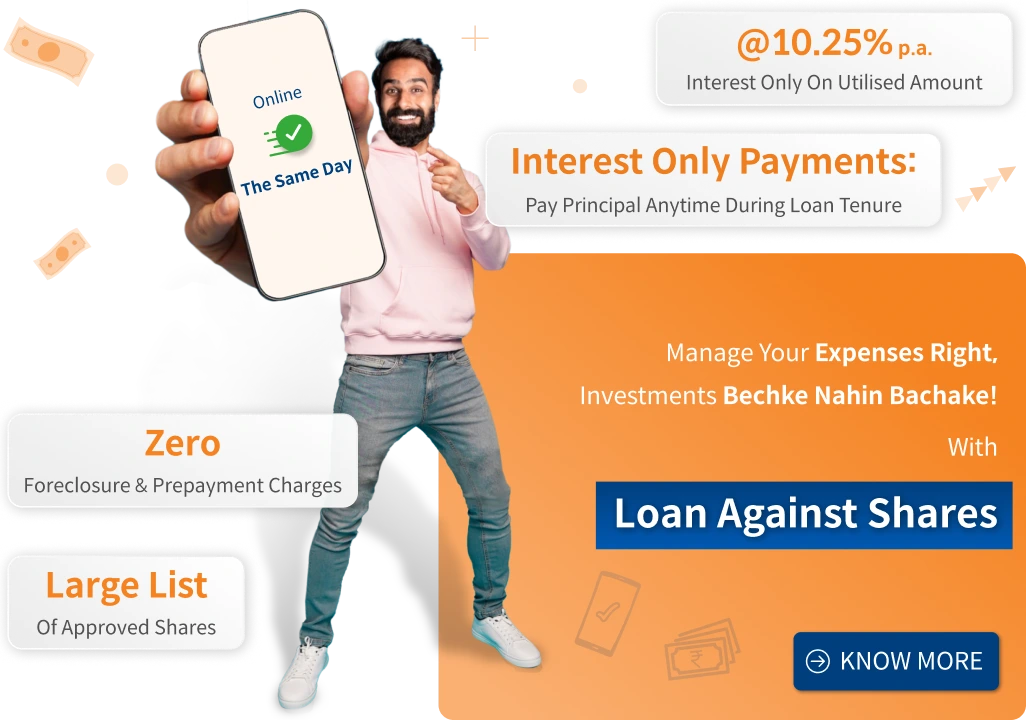

Loan Against Shares

10.25% .p.a

Same Day

Personal Loan

Personal Loan specially curated for salaried individuals to bridge the gap between your expenses and your budget. Complete the application without any branch visits or physical paperwork. Customize the repayment schedule and tenure as per your requirement with Flexible EMI options.

Loan Against Mutual Funds

Loan Against Mutual Funds enables you to raise funds within minutes by pledging your mutual funds as collateral via CAMS or Kfintech. Thus retaining the ownership of your investments for long-term goals while funding your short-term money needs. This also helps you avoid charges and capital gain taxes associated with the redemption of your mutual fund units.

* The interest rate will vary depending on your credit profile, employment info, and salary details.

** 10 minutes loan sanction time. Funds will be disbursed within 2 business days subject to successful verification.

^ Maximum pre-payment allowed during the lock-in period is the equivalent of one EMI amount. If the loan is closed during the lock-in period, 6 months of interest amount will be applied to the account.

Manage Account With Digital Dashboard

- Mobile App

- Website

Personal Loan

Loan Against Securities

Personal Loan

Loan Against Securities